Main General Ledger

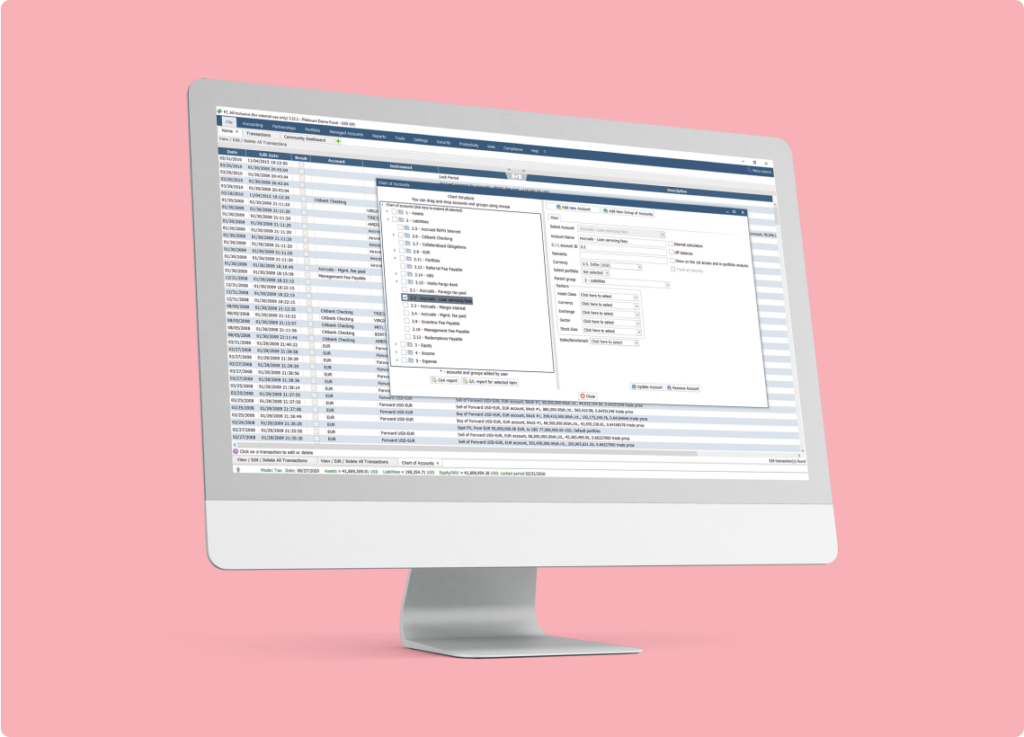

General Ledger

Speed up reconciliation through our real-time general ledger, integrating both investment and investor accounting for precise reporting

Multi-currency, multi-book general ledger

Utilize FundCount’s multi-currency, multi-book general ledger to support both IFRS and GAAP accounting. Eliminate the need for multiple accounting/reporting cores.

Partnership and portfolio accounting core

Rely on a unified core for partnership and portfolio accounting. Post data directly into the GL, ensuring immediate access to financial reports without waiting for period closures.

Real-time financial reporting

Tailor your real-time chart of accounts and set user-specific mapping. Consolidate financials across entities and promptly deliver income statements, balance sheets, and NAV reports.

Client-focused reporting

Deliver visually appealing and transparent client statements with customizable on-demand reports, including capital statements, performance reports, and more to meet diverse reporting requirements.

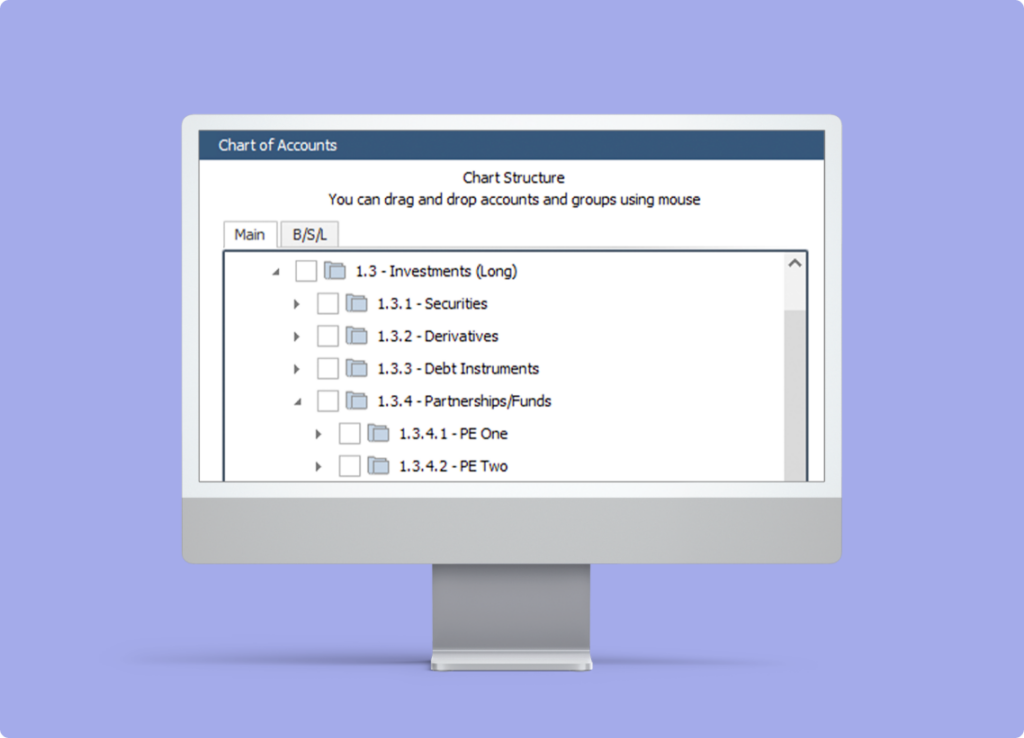

Customizable chart of accounts

Adapt the system’s standard CoA to your preferences. Set your mapping for investment holdings, sectors, bank accounts, and other essential line items your organization demands.

Overview of tax reporting management

Boost efficiency with FundCount’s automated client and tax reporting. Map accounts to IRS Forms 1065 and K-1. Track tax, book appreciation, and costs to individual tax lots and series.

How it works

This diagram offers a comprehensive view of how FundCount simplifies complex data and operating environments.

On the left, you’ll find external inputs, while the right showcases key outputs. The center highlights where FundCount’s magic occurs. The grey streams between them illustrate the complex interrelationships from input to output data. FundCount is designed to handle this complexity, transforming diverse data sources into meaningful outputs.

FundCount unified platform removes the need for reconciliation and integration work efforts between modules and associated limitations in speed, accuracy and data insights. Deliver more accurate reports to your clients faster at a fraction of a cost!

Request a Live Demo

See FundCount’s integrated accounting and reporting solution in action!