Main Fund Administration

Fund Administration

Benefits

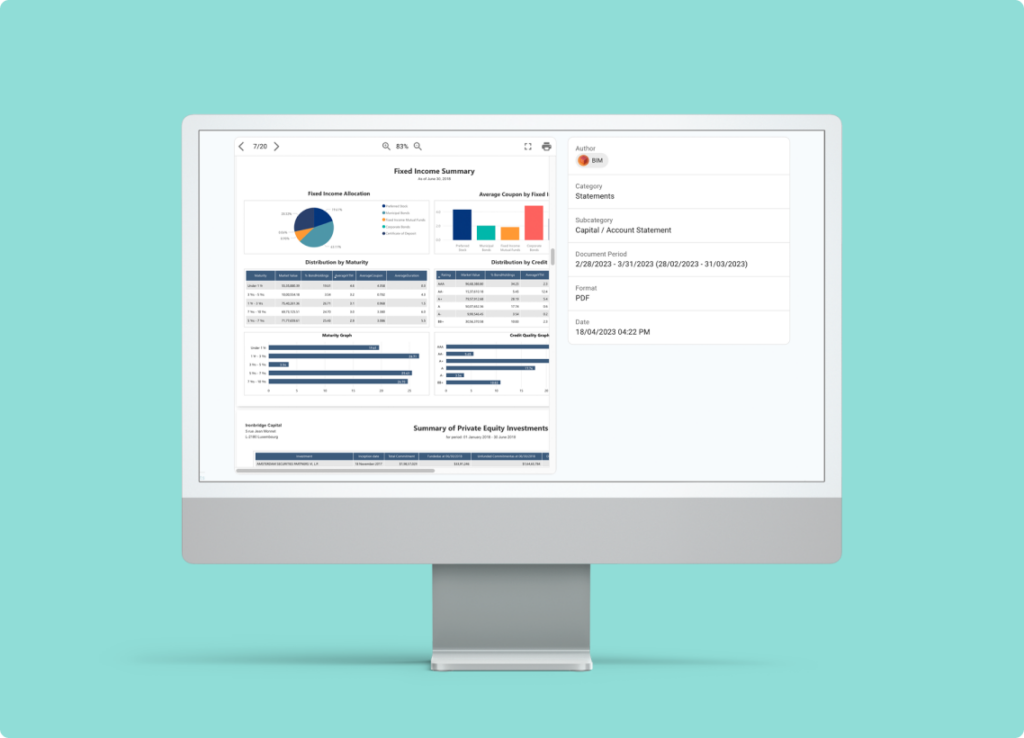

Aggregated information

Utilize the fund management platform to seamlessly aggregate data from various sources into a single, unified system. Move away from unreliable spreadsheets by automating data imports, ensuring both increased accuracy and rapid processing.

Scalable for growth

Complete accounting and analysis for all investments, securities, and fund structures, enabling limitless growth in client services, expanding your business with confidence.

No more error-prone spreadsheets

Transition away from error-prone spreadsheets by consolidating data from diverse sources into one integrated system. Implement seamless data synchronization for superior precision and efficiency, eliminating the need for unreliable manual processes.

New level of client communications

Full operational support

Built-in flexibility

How it works

This diagram offers a comprehensive view of how FundCount simplifies complex data and operating environments.

On the left, you’ll find external inputs, while the right showcases key outputs. The center highlights where FundCount’s magic occurs. The grey streams between them illustrate the complex interrelationships from input to output data. FundCount is designed to handle this complexity, transforming diverse data sources into meaningful outputs.